RF Insurance Masters wants to make sure you understand health insurance basics so when you are choosing a plan, you can make a sound decision. Are you considering COBRA? Are you looking to establish a Group Health Plan for your company and want to know what you need to get one started?

RF Insurance Masters wants to make sure you understand health insurance basics so when you are choosing a plan, you can make a sound decision. Are you considering COBRA? Are you looking to establish a Group Health Plan for your company and want to know what you need to get one started?

We always recommend working with an insurance agent that you feel comfortable with to help provide advice and guidance you need to select the best plan based on your particular situation. We know that there is not one plan that is right for everyone, though we know we can find the best solution for your particular needs and situation. I wanted to review a few items to help you understand the various features and option basics. Learn about Our Approach to providing health insurance.

It is important to know, that working with an agent can give you very specific information and advice on each plan that they have to offer. There are a few items that everyone needs to consider as they are choosing a health insurance plan. One thing to know about shopping for insurance online and when you are seeing a quote for a plan and they show the monthly premium. The premiums vary by deductible, coinsurance, copays and max out of pocket features of the plan. These items are the basic that you will need to look at as you are shopping for insurance are (it does require you to review your particular plans summary of benefits in detail to know the plans coverage) :

- Deductible

- Coinsurance

- Coinsurance Out of Pocket Max

- Copays

- Prescription Coverage

- Medical and Prescription Max Out of Pocket

- Lifetime Maximum

Deductible is the amount of out of pocket that you will be exposed to if you have an accident or illness. This is the first set of medical expenses that you are faced with and responsible for paying. These costs are paid by you are the Network Pricing that the insurance company negotiated with the provider or the allowable amount. One thing to know is that Copays for doctors’ visits, do not count toward your deductible, they will count toward your max out of pocket though.. For example, if you had a policy that had a $2,500 deductible, this first $2,500 is your responsibility. For families, your family deductible is two or three times this deductible depending on the plan chosen. You need to review this in detail with the summary of benefits.

How do you select the deductible that is best for you, we would review your past history to see how much you have spent on medical claims or issues. Everyone’s situation is different. If you are not sure, you can work with an agent to determine the best for you. Your on-hand cash may have you consider different deductible levels. The way to save on premiums would be to consider raising your deductible.

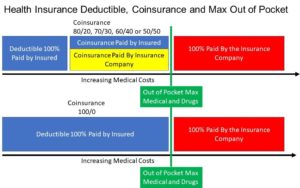

Coinsurance is the portion after meeting your deductible that you and the insurance company share the next set of medical expenses. These coinsurance values come in various configurations, such as 100/0, 90/10, 80/20, 70/30, 60/40 and 50/50. The first number is the percentage that the insurance company pays, the second number is the percentage that you will pay. For example, if you went over your deductible by $10 and you had an 80/20 coinsurance plan, then you would pay $2 of the $10 in medical expense, the insurance company would pay $8.

Coinsurance Out of Pocket Max is the maximum amount of coinsurance money you will be responsible for paying in the event of a serious illness or injury. It is the limit you will be responsible for. For an individual will be this number, and for a family it will be two or three times this amount depending on your plan. Review your summary of benefits to see the details on your plan.

Your total annual exposure for a serious accident or injury is the Coinsurance Out of Pocket Max Plus your Deductible. For the family it the family limited added together. After you spend this on your medical expenses, the insurance company will pay any additional medical expenses. This is the reason you need to have health insurance is to limit your medical dollars and protect you from bankruptcy.

Medical and Prescription Max Out of Pocket is the total of the deductible, coinsurance paid by the insured and copay that you will pay. This number is your maximum annual liability for the policy. After you pay this amount, your insurance company should cover 100% of any additional charges.

Above are two examples that you can consider to help understand 80/20, 70/30, 60/40 or 50/50 (First number is the insurance company portion, and the second number is your portion (80% paid by insurance company and 20% paid by the insured until the Out of Pocket Max is met)) and 100/0 coinsurance. The left side to the right is increasing medical expense dollars.

Copays are a benefit in some plans that lets you get into the doctors office for a certain price $25, $30, $35, or $50 for example. Some have two levels of copay for general doctors and specialists. Some plans do cover lab work, but most lab expenses will be billed to you review your plans specifics to be sure. These copays do not count toward your annual deductible. Some plans are available without any copays, and removing this feature can reduce the premium. You can consider this if you do not go to the doctor often. Some plans have unlimited visits and some have limited visits such as 3, 4 or 6. Please review you plan with your agent to understand any limits.

Annual Wellness/Physicals – These are now included with individual major medical plans as no cost or a copay for these benefits. Each plan is different so you will need to review the summary of coverage. These physicals will cover blood work, PAP, mammogram, colonoscopy, etc required to keep your health checked out. This will make wellness more accessible to keep up with your annual physicals.

Prescription Coverage sometimes comes with the major medical plan. Some plan will offer a generic and brand names without any prescription deductible, and sometimes there is a $200, $500 or $1000 brand name deductible, and generics are not subject to deductible. Some plans do not offer any coverage until you reach you plans deductible and coinsurance out of pocket maximum. Please review your summary of benefits to be sure of what coverage you have with your plan. Your agent can help guide you.

Lifetime Maximum is what the maximum the plan will payout as long as you are on the plan. Since health care reform came into place as of January 2011, all plans have Unlimited Annual and Lifetime Maximum. This allows for no cap on payout from the insurance company when you have insurance in-force.

You are now ready to begin your search for the best plan for you contact us to help and advise you on the best options out there for you. Just click the free quote button of give us a call.

Other Topics of Interest:

- Our Approach to finding affordable Health Insurance – See our unique approach to saving on health insurance.

- COBRA – Understand COBRA and your options/risks

- Group Health Insurance Information